When it comes to financial planning, individuals often seek avenues that not only provide returns on investment but also offer tax-saving benefits. One such instrument gaining popularity in India is Tax Saving Fixed Deposit Schemes.

In this guide, we will delve into the intricacies of tax-saving fixed deposit schemes, providing insights into the top options for 2024, how these schemes help save taxes on FD returns, reasons to choose them, and essential features and eligibility criteria.

Table of Contents

What is Tax Saving Fixed Deposit Schemes?

Tax Saving Fixed Deposit Schemes are specialized financial instruments designed to offer dual benefits – assured returns on your investment and the opportunity to save on income tax. These fixed deposit schemes come with a lock-in period, during which the deposited amount cannot be withdrawn, ensuring stability and security.

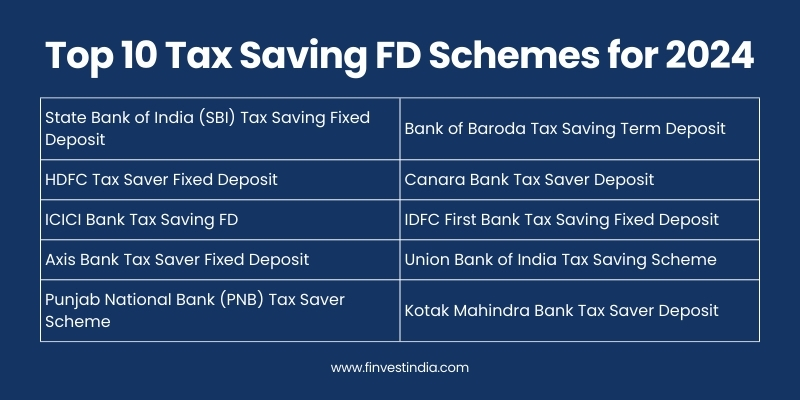

Top 10 Tax Saving FD Schemes for 2024

- State Bank of India (SBI) Tax Saving Fixed Deposit

- HDFC Tax Saver Fixed Deposit

- ICICI Bank Tax Saving FD

- Axis Bank Tax Saver Fixed Deposit

- Punjab National Bank (PNB) Tax Saver Scheme

- Bank of Baroda Tax Saving Term Deposit

- Canara Bank Tax Saver Deposit

- IDFC First Bank Tax Saving Fixed Deposit

- Union Bank of India Tax Saving Scheme

- Kotak Mahindra Bank Tax Saver Deposit

How Above Schemes Help You Save Tax on your FD Returns?

Tax-saving FD schemes provide investors with deductions under Section 80C of the Income Tax Act. The deposited amount, up to a specified limit, qualifies for a deduction, reducing the taxable income. Interest earned is also subject to tax benefits, making these schemes an attractive option for those looking to optimize their tax liabilities.

Why You should Choose Tax Saving FD Schemes in India?

- Guaranteed Returns: Tax-saving FD schemes offer assured returns on investment, providing financial stability.

- Tax Benefits: Enjoy deductions on your taxable income under Section 80C, reducing your overall tax liability.

- Fixed Tenure: The lock-in period ensures financial discipline and discourages premature withdrawals.

- Low Risk: Tax-saving FDs are considered low-risk investments, making them suitable for conservative investors.

- Ease of Investment: Opening a tax-saving FD account is a hassle-free process, often available both online and offline

How does Tax Saving Fixed Deposit Schemes Work?

Investors deposit a lump sum amount in a tax-saving Fixed Deposit scheme for a fixed tenure, typically ranging from 5 to 10 years. The interest rates are predetermined and may vary among different banks. The principal amount qualifies for deductions under Section 80C, and the interest earned is taxable but eligible for exemptions up to a specified limit.

Important Features of Tax-Saving Fixed Deposit Schemes

Lock-in Period:

Tax-saving FDs come with a mandatory lock-in period during which premature withdrawals are not allowed.

Interest Rates:

Fixed interest rates are determined at the time of investment and remain unchanged throughout the tenure.

Nomination Facility:

Investors can nominate a beneficiary to receive the benefits in case of unforeseen circumstances.

Renewal Options:

Some schemes offer the option to renew the FD upon maturity, ensuring continued tax benefits.

Joint Accounts:

Tax-saving FDs often allow joint accounts, facilitating investments for family members.

Explore More FD Tax Benefits with Us!

Tax-Saving Fixed Deposit for Section 80C Deductions

A fixed deposit account comes in numerous forms to help individuals and entities save funds for their future. The general FD accounts allow you to choose the tenure of the account based on your convenience. In addition to the general FD accounts, many banks offer a five-year FD scheme that is meant for tax savings.

One can claim an income tax deduction by investing money in a five-year FD scheme under Section 80C of the Income Tax Act, of 1961. The features, benefits, and terms associated with this type of account may not be completely the same as the normal FD accounts. There are a number of things you need to know about such FD accounts to make use of the benefit.

Benefits of Tax-Saving Fixed Deposits

A fixed deposit account is a financial tool that has enjoyed the iron-clad trust of the general population over the decades when it comes to savings. Since it is a bank-based investment product closely monitored by the RBI, investors are assured of its safe and low-risk nature. The money deposited is also easily redeemable with interest upon maturity.

Some of the Benefits of FDs are:

- FDs have a higher interest-earning potential than savings accounts.

- Interest earned on fixed deposits is subject to TDS.

- FDs offer flexibility in the deposit amount based on the investor’s convenience.

- Investors can get income tax deductions up to Rs.1,50,000 per annum under Section 80C of the Income Tax Act, 1961.

Latest News on Fixed Deposit

RBI has announced a new rule applicable to unclaimed, matured FD accounts. That is the funds in an unclaimed, matured FD account will attract an interest rate as applicable to the savings account or the contracted rate of the matured FD, whichever is lower.

Eligibility for Fixed Deposits in Tax Savings Schemes

Individuals and Hindu Undivided Families (HUFs) are eligible to invest in tax-saving Fixed Deposit schemes. Most banks offer these schemes to both new and existing customers, providing a flexible investment avenue for various financial profiles.

Documents Required to Open a Tax Saving FD Account

- KYC Documents: Proof of identity and address such as Aadhar card, passport, or voter ID.

- Photographs: Recent passport-size photographs of the account holder(s).

- PAN Card: Permanent Account Number (PAN) card is mandatory for tax-related transactions.

- Form 15G/15H: For individuals seeking tax exemption on interest income, if applicable.

While optimizing your tax-saving strategies, it’s crucial to secure your family’s well-being. Finvest India offers comprehensive family health insurance plans that fit your budget. Protect your loved ones from unforeseen medical expenses and ensure financial security in times of need.

In conclusion, Tax Saving Fixed Deposit Schemes provide a unique blend of financial stability and tax benefits. As investors navigate through the diverse options available, understanding the features, eligibility criteria, and documentation requirements is crucial. By incorporating tax-saving FD schemes into your financial portfolio, you not only save on taxes but also ensure a secure and disciplined approach to wealth creation.