Have A Financially Secured Retired Life with Solid Retirement Plan

Get Started with Best Retirement Plan Consultant

Our consultants plan your retirement by suggesting you best investment options that protect you throughout the retirement phase. Get started with us now!

What is Retirement Plan?

A retirement plan means having sufficient funds to provide you with a comfortable lifestyle when you retire. Most people face three questions when they start thinking of retirement

Why Finvest India Should Plan Your Retirement?

We bring comprehensive solutions to achieve your dream...

- We have 20 Years of Experience in offering consultation for Retirement Plans

- We have built enough retirement funds to enjoy hassle free retirement

- We have proven Asset Allocation strategy to curb Inflation loss & get adequate returns

- We track & re-balance them to protect investments from Market Volatility

What do our Retirement Plan Consultants do?

Our Consultants help you with investing options optimized for your goal!

Our Consultants understand your retirement goals, current income & family conditions. Once, they are clear with these data, our consultants list feasible investing options to reach your Retirement Goal. They also explain the Returns & other benefits of available investments. Then you can take a decision based on our consultant’s advice.

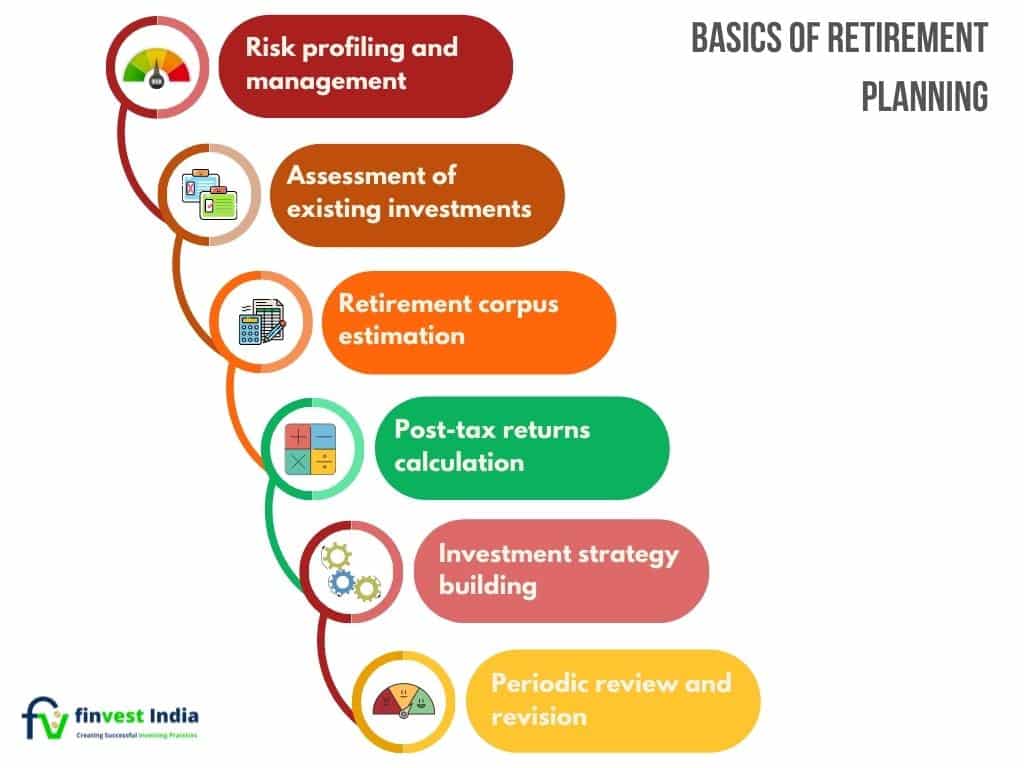

Basics of Retirement Plan

- Risk Profiling & Management

- Assessment of Existing Investments

- Retirement Corpus Estimation

- Post-Tax Returns Calculation

- investment Strategy Building

- Periodic Review & Revision

Why Do You Need Retirement Plan?

Inflation

Every year value of your money reduces. The increase in the price of commodities is a fact. It happens little by little each year and has a massive impact on your earnings over a few years. You may need a good pension plan to prepare for inflation.

High Medical Expenses

The decline in one’s health is inevitable as we move across an old age. A correct retirement plan ensures that all your medical expenses and other needs are taken care of pre-han

No state-sponsored pension

There are no government-sponsored pension programs that focus on retirement plans. So, it is crucial to start planning for your retirement as soon as you start earning. The sooner, the better.

When You Should Start Investing in Retirement Plans?

A well-built retirement plan has 3 phases

Investment Phase

Investment is the initial phase where the investor sets his investment objectives and starts investing in the fund. Start happens from his 30’s till his 50’s. The best time to start retirement planning is in your 20s

Accumulation Phase

The retirement fund gets accumulated over time. You get the interest over interest leading to a large corpus of wealth over time Finvest India helps you plan and guides the accumulation of funds in a diversified portfolio

Systematic Withdrawal Phase

In this phase, you harvest the money you have been investing in all your working life.

A retirement plan is done to support you with a monthly income when your active source of income diminishes. As one comes near retirement age, one should always ensure that all the corpus accumulated over the years shall slowly and casually move to secure from all the risky funds. This way, the investor can ensure that the entire corpus is safe from market volatility.

Frequently Asked Questions

Few Questions About Retirement Plan in Bangalore

Whom should I consult to plan my retirment?

You should consult Financial consultant to plan your Retirements. It is always advisable to consult experienced & specifically skilled Retirement Plan Consultant for better investment advise & decisions.

Why do I need to invest in Retirement Plan?

During your mid-age life, there are lot of over-expenses which might lead to shortage of funds during your retirement life. Hence, it is always suggested to invest in Retirement plans.

What are the types of Retirement?

There are 3 types of retirements – Traditional Retirement, Semi Retirement, Temporary Retirement.

Does LIC provides retirement plans in India?

Yes, LIC provides lot of retirement plans which helps you as a Pension during your retired life. To know more about this, consult our expert.

What is the safest retirement plan?

The safest way to invest in retirement plan is to invest in guaranteed growth plan with low risk associated with it. This provides a surety of fund security.