As individuals gracefully transition into their golden years, safeguarding their health becomes paramount. The need for comprehensive health insurance for senior citizens cannot be overstated, particularly given the unique healthcare challenges that arise with age.

In this blog, we delve into the significance of health insurance for seniors, focusing on the Indian landscape and shedding light on the benefits, reasons to opt for comprehensive coverage, and the steps to purchase a suitable plan.

Table of Contents

Introduction to Comprehensive Health Insurance for Senior Citizens

Obtaining medical insurance for senior citizens was almost impossible in the past insurance companies permitted renewal only if you have been a policyholder with them without a break.

However, the Insurance Regulatory and Development Authority of India has instructed companies to set 65 as the highest age for entry into health insurance plans.

Health Insurance for Senior Citizens refers to the reimbursement or indemnification of expenses incurred on account of medical conditions, exclusively for senior citizens.

What is Comprehensive Health Insurance for Senior Citizens?

Comprehensive health insurance for senior citizens is a specially tailored insurance policy that provides extensive coverage for medical expenses incurred during their later years. These plans go beyond basic coverage and encompass a wide range of healthcare needs, including hospitalization, pre and post-hospitalization expenses, diagnostic tests, and even critical illness coverage

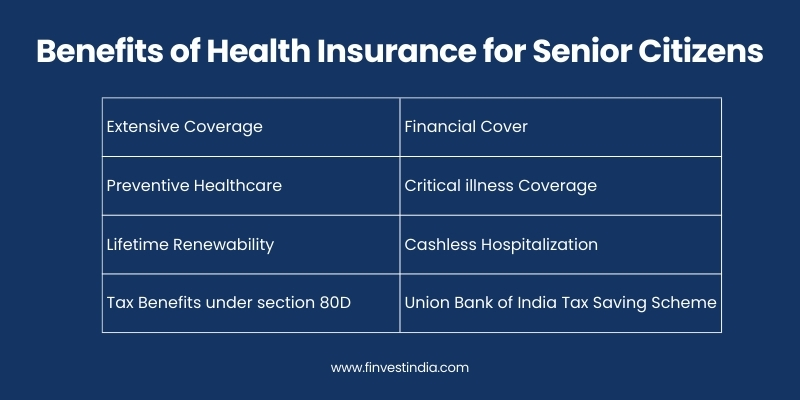

What are the Benefits of Comprehensive Health Insurance for Senior Citizens?

- Extensive Coverage: Unlike standard health insurance plans, comprehensive health insurance for seniors offers broader coverage, ensuring that a myriad of medical expenses is taken care of.

- Financial Cover: In uncertain times, health insurance policies ensure that you get protected from unexpected and expensive financial costs and have a safety net to fall back on. While different companies offer varying products, almost all policies cover a wide range of illnesses and their ailments.

- Preventive Healthcare: Many comprehensive plans include preventive healthcare services, encouraging seniors to undergo regular health check-ups, leading to early detection and prevention of potential health issues.

- Critical Illness Coverage: Senior citizens are often more susceptible to critical illnesses. Comprehensive health insurance plans typically include coverage for critical illnesses, offering financial protection during challenging times.

- Lifetime Renewability: A crucial feature of these plans is the option for lifetime renewability, allowing seniors to continue their coverage without the fear of losing it in their later years. Medical insurance for senior citizens can not only be taken at the maximum age of 65 years but can also be renewed up to 80 years of age. Some companies allow renewability up to the age of 90 years, provided there has been no break in payment of premium since the policy was first taken.

- Cashless Hospitalization – Most companies that offer insurance plans to senior citizens allow cashless transactions, i.e., a benefit where the hospital can claim payment for the rendered treatment directly from the insurer.

- Tax Benefits U/S 80D – It is important to note that health insurance for either yourself or for family members has the added benefit of reducing taxable income. If you purchase a health plan, you are eligible to get a tax deduction under Section 80D.

Better Reasons to Choose Comprehensive Health Insurance

- Tailored for Seniors: These plans are specifically designed to cater to the healthcare needs of seniors, considering the age-related health challenges they may face.

- Financial Security: Comprehensive health insurance provides financial security by covering not only hospitalization expenses but also other medical costs, ensuring that seniors can access quality healthcare without worrying about the financial burden

- Customizable Add-ons: Many policies offer customizable add-ons, allowing seniors to tailor their coverage based on their specific health requirements.

How to Purchase Comprehensive Health Insurance for Senior Citizens?

- Tailored for Seniors: These plans are specifically designed to cater to the healthcare needs of seniors, considering the age-related health challenges they may face.

- Financial Security: Comprehensive health insurance provides financial security by covering not only hospitalization expenses but also other medical costs, ensuring that seniors can access quality healthcare without worrying about the financial burden

- Customizable Add-ons: Many policies offer customizable add-ons, allowing seniors to tailor their coverage based on their specific health requirements.

What Does Comprehensive Health Insurance Policy Covers for Senior Citizens?

Several features must be checked before opting for a health insurance policy that best suits you. Read the fine print and make sure you go over all the options available. The most obvious and important factor to consider is the extent of the cover provided. Depending on the vendor, there may be slight variations in product offerings. Still, a good outline of what you can expect in a health insurance policy or a Mediclaim Policy for Senior Citizens is listed below:

- Hospitalization Expenses – These relate to direct expenses incurred on account of hospitalization. Doctor visits, room charges, cost of medication, and surgery are entirely covered by an insurance policy, subject to the financial limit of the plan. Certain companies also offer pre- and post-hospitalization coverage for a specified period.

- Daycare Expenses – A few procedures like chemotherapy and dialysis do not require hospitalization. However, most such medical procedures are also enlisted as ‘Inclusions’ in most Health Insurance Policies for Senior Citizens.

- Pre-Existing Conditions – While pre-existing medical conditions are not covered from the moment the policy is drawn, most medical insurance companies, usually after one year, offer a cover to most pre-existing conditions.

Some Special Features of Comprehensive Health Policy

Whether you choose to take up a Health Insurance or a Mediclaim for senior citizens, you are eligible for certain benefits:

- NO CLAIM BENEFIT: Most insurance companies offer a ‘No Claim Benefit’ wherein your premium is discounted if you have not made any insurance claims in the previous financial year. Some companies offer reimbursement for a health check-up every 3-4 years of ‘No Claim’ in addition to the benefit in premium.

- TAX GAIN – As a policyholder, under section 80D of the Income Tax Act, you can claim a deduction for an annual premium amount not exceeding ₹ 50,000 in a financial year.

Read This – 7 Unknown Secrets To Reduce Your Health Insurance Premium

Factors to Consider When Comparing Senior Citizen Health Insurance

A few things that you should keep in mind before opting to purchase health insurance for the senior citizens in your family, like your parents, grandparents, and your in-laws are:

- Coverage: Firstly, it is important to understand the kind and amount of coverage that is needed. A few things that you must pay more attention to during this phase of the health insurance buying journey are medical history, medical requirements, health concerns if you have a spouse, your spouse’s health concerns, age, and current financial situation. All these factors will influence the amount of cover needed.

- Lifetime Renewal: You must check if the health insurance for senior citizens plan you choose comes with a lifetime renewal option or not. You will have to decide regarding the renewal option after a certain point. It does make sense to choose a plan with a lifetime renewal option for senior citizens because with age also comes an increased requirement of medical help, medical attention, and increased medical care costs. Hence, Lifetime renewal is something that you must give a hard think about.

Know More About TPA in Health Insurance - Pre-Existing Conditions: With age also comes ailments. Something that we can’t ignore. Hence it is highly important to keep a check on all pre-existing conditions and hereditary medical conditions. You should look at the entire list of medical diseases and ailments that the health insurance policy for senior citizens covers before buying it. The longer the list, the better.

- Co-Payments: While buying health insurance for senior citizens, you will notice that most plans come with a co-pay. This determines how much money you might have to pay from your pocket. Hence, it makes apt sense to choose a plan with the least amount of co-pay to ensure that you do not have to dip into lifetime savings.

Exclusions in Senior Citizen Health Insurance

- Illnesses contracted within 30 days of signing up for the policy

- Dental treatment, except in cases arising out of an accident

- HIV/AIDS

- Cosmetic Surgery

- Vaccination/Inoculation

- Illnesses contracted in times of war or nuclear attacks

Plan Your Retirement with Health Insurance:

Planning for retirement involves not only financial considerations but also prioritizing health. Comprehensive health insurance provides a safety net, ensuring that seniors can enjoy their retirement years without the stress of unforeseen medical expenses. Good to Know this – Retirement Planning for Bangalore Residents

Conclusion

Senior Citizens are often the most neglected category as far as insurance coverage is concerned. Apart from being necessary, insurance, be it a health insurance policy or a mediclaim for senior citizens is quintessential in leading a worry-free and hassle-free life. However, finding the right policy that suits both, your requirements and your budget may qualify as a challenging task.

A little patience and thorough research can help you find that ideal plan that will financially protect you from most untoward medical circumstances. Health insurance benefits are many – the goal is to find the right insurance policy.

Contact Finvest India at +919008062350 to get the best Senior Citizens Health Insurance policy.