Table of Contents

How to Decide The Amount For Health Insurance Coverage?

n this grand symphony of health protection, understanding why one must meticulously decide on the ideal health insurance coverage is akin to grasping the rhythm that guides the orchestra. Imagine your health as a melody and your insurance as the harmonious notes that weave a protective sonnet around it. Choosing the right coverage ensures that your life’s melody continues without a discordant note, shielding you from unexpected medical expenses and financial stress. By selecting the perfect coverage amount, you not only safeguard your health but also secure long-term peace of mind and financial stability.

Why Calculate Ideal Coverage Amount?

Now, you may wonder, why delve into the intricate world of calculating the ideal coverage amount?

The answer lies in the unpredictability of life’s tempests.

Life has a penchant for tossing unexpected challenges our way, from minor skirmishes to grand battles. Calculating the ideal coverage amount becomes our shield against the unforeseen, offering a sanctuary where we can weather the storms with resilience and grace

How to Calculate Ideal Coverage Amount? Step by Step Guide

Behold! The curtain rises on the mystical dance of calculating the ideal coverage amount. Brace yourselves as we unveil the steps to this captivating choreography:

- Know Thyself: Begin by introspecting your health needs, considering factors like age, existing health conditions, and lifestyle. It’s like sketching the outline of a masterpiece; you are the artist, and your health is the canvas.

- Future Gazing: Peer into the crystal ball of the future. Anticipate potential health scenarios and estimate the costs that might arise. This step is akin to composing the future movements of your health symphony.

- Financial Jigsaw: Assess your financial landscape. What can you comfortably allocate to health insurance premiums? Like a skilled conductor balancing instruments in an orchestra, find the harmony between your budget and desired coverage.

- Consult the Oracle – Health Insurance Calculator: Invoke the powers of modern technology – use health insurance calculators! These digital oracles can compute intricate equations in seconds, unraveling the ideal coverage amount like a magician revealing secrets.

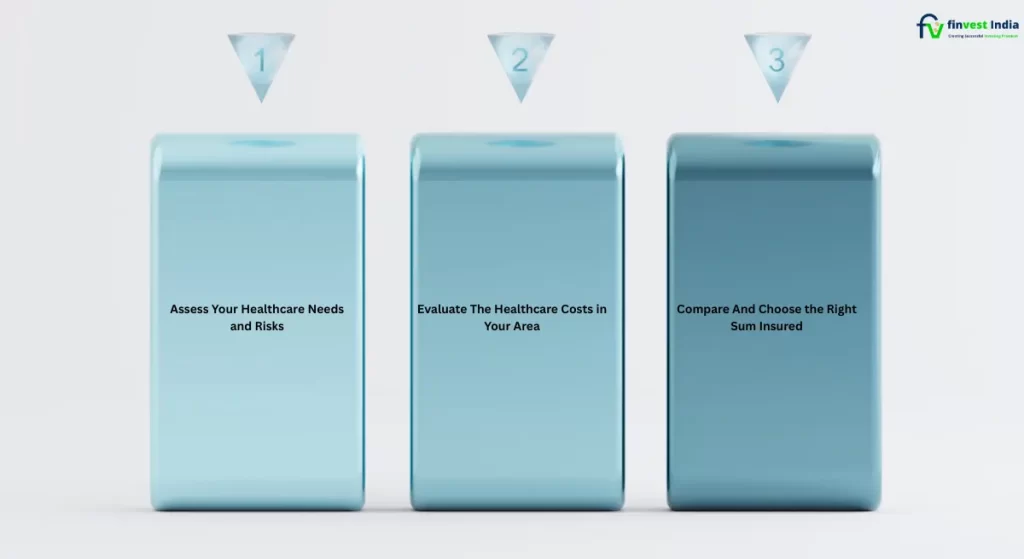

Three Steps to Calculate Your Health Insurance Coverage in India

Approach the Best Insurance Agencies to Calculate Ideal Coverage for Health Insurance? Now, why navigate this labyrinth alone when you can have expert guides to illuminate the path? best insurance agencies are the seasoned maestros of the health insurance symphony. They possess the knowledge, experience, and a vast repertoire of plans, ensuring you find the perfect crescendo of coverage tailored to your needs. Collaborating with these virtuosos transforms the process into a harmonious duet, where your needs and their expertise create a melody of security.

Step 1: Assess Your Healthcare Needs and Risks

a. The first step in determining the correct sum insured is to assess your healthcare needs and risks.

b. Consider your age, lifestyle, and medical history to identify potential health risks and expenses. For example, if you have a family history of medical conditions, you may be at a higher risk of developing similar health problems.

c. Additionally, your lifestyle, such as smoking or lack of exercise, can increase the risk of health issues like heart disease, diabetes, and cancer. Determining the expected healthcare expenses for you and your family is also essential. This can include the cost of doctor consultations, diagnostic tests, medications, and hospitalization. If you have children or elderly parents as dependents, you may also need to factor in their healthcare expenses.

Step 2: Evaluate The Healthcare Costs in Your Area

a. The next step is to evaluate the healthcare costs in your area. Research the average healthcare costs in your city or state to understand the potential expenses you may incur. This can include the cost of hospitalisation, surgeries, and treatments.

b. You would also need to factor in the cost of diagnostic tests, medications, and consultations.

c. By understanding the healthcare costs in your area, you can make an insightful decision about the sum insured you would need for your health insurance plan.

d. This will ensure adequate coverage for potential healthcare expenses and avoid unexpected out-of-pocket costs.

Step 3: Compare And Choose the Right Sum Insured

a. The final step is to compare and choose the correct sum insured for your health insurance plan.

b. Compare the potential healthcare expenses and costs with different sum insured options to find a plan that fits your needs and budget.

c. If you select a higher sum insured for your health insurance, the insurance company will compensate you with a greater amount in the event of a claim. However, this also means that you will have to pay higher premiums for the increased coverage.

d. Finally, consider the coverage benefits and exclusions for each plan to ensure that you have adequate coverage for your healthcare needs

It is important to note that the cheapest plan may not always be the best option. It is crucial to balance the premium cost with the coverage benefits to find a plan that fits your healthcare needs and budget.

Smart Tips To Reduce Premium For Health Insurance

- Always prefer long-term policies.

- Buy health insurance at a young age.

- Don’t opt for unnecessary add-ons.

- Always compare different plans and then choose the best plan based on coverage, network hospital, and claim settlement ratio

- If current premium are high then there is a option to port the policy to different insurer

- Always go for family floater plan where multiple member can get coverage with single premium

How often we should review the health insurance coverage?

- We can review the policy annually to check whether the cost, benefit, and coverage are suitable or not.

- We should reassess the policy after major changes in life, such as after marriage, having a baby, or losing a job, to know whether coverage is aligning with the needs or not

Conclusion:

And there you have it: the masterpiece of ideal health insurance coverage, painted with the vibrant hues of self-awareness, foresight, financial prudence, and expert guidance. As you step into the realm of calculated security, envision it as a grand performance where your health takes centre stage, accompanied by the resounding symphony of protection crafted by With Finvest by your side, your health journey becomes a magnificent composition filled with notes of wellness, financial security, and peace of mind.

At Finvest India, we understand that your healthcare needs evolve with time. That’s why it is essential to reassess your health insurance coverage and sum insured regularly. As your lifestyle and priorities change, so will your medical expenses and protection requirements. Regular evaluations ensure that you always stay adequately covered and avoid unnecessary financial strain.

When you’re ready to buy health insurance, Finvest India will guide you through every step. Our experienced professional helps you compare, customise, and choose the most suitable plan that fits your budget and healthcare needs—covering aspects like pre-existing conditions, elderly parent coverage, OPD expenses, and more. With Finvest, you don’t just buy insurance—you invest in your health, security, and future.