Home > Single Transit Policy

Single Transit Policy

Safeguard your products from unwanted damage or loss during their journey with a comprehensive single transit policy tailored to your business needs.

What is Single Transit Policy in Marine Insurance?

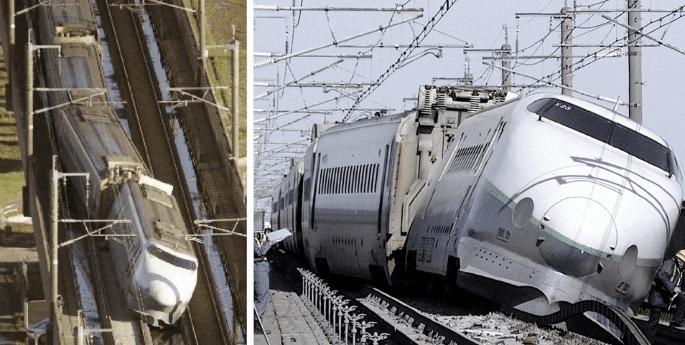

Marine insurance policies protect goods throughout their journey from their starting point to their final destination.These policies cater to various modes of transportation, encompassing road, air, rail, sea, courier, and postal services, offering protection against potential loss or damage.A single transit policy is a subset of marine insurance that provides coverage for a specific journey between two points. It is crafted to shield cargo during transportation, whether by truck, railway, ship, or airplane, from its place of origin to its intended destination.This policy ensures protection throughout the entire movement, regardless of the transportation method chosen.Its primary aim is to cover a distinct shipment or transit event, distinguishing it from policies that offer continuous coverage for numerous shipments.The most common causes of cargo loss or damage during transit include events such as explosions, fires, hijackings, collisions, accidents, and vehicle overturns.This policy also extends its coverage against a range of risks that cargo may encounter during transportation, including strikes, theft, and riots.Moreover, a single transit marine insurance policy can encompass meticulously crafted plans that cover malicious damage, theft, damages encountered during loading and unloading processes, non-delivery of items, and mishandling of cargo specific to the transit.The coverage offered can be meticulously tailored to align with your unique requirements. It is available for an extensive array of goods or cargo, irrespective of whether they are manufactured or traded by you.

Features of Single Transit Policy in Marine Insurance

- Contrary to open or continuous marine insurance policies, which cover multiple shipments over a designated time frame, a single transit policy is devised specifically for a solitary journey or shipment.

- The policy is fashioned to resonate with the exact transit event it ensures.

- The coverage terminates once the shipment arrives at its destination.

- It is conceptualized for businesses that sporadically dispatch shipments.

- Single transit policies can be adjusted and tailored according to the unique needs of the insured and the characteristics of the cargo.

- These policies are generally straightforward to secure and oversee, given that they aren't as extensive as perpetual marine insurance policies.

- Owing to the coverage being restricted to just one shipment, the premium for a single transit policy tends to be lower in comparison to the more exhaustive and continuous marine insurance policies.

Who needs Single Transit Policy?

Single transit insurance policies cater to a broad spectrum of businesses across diverse sectors. Below are a few instances of businesses that stand to benefit from adopting such a policy:Exporters or importers with intermittent shipment schedules.Enterprises that participate in trade exhibitions, fairs, or events necessitate temporary transportation of commodities.Organizations that periodically transport high-value cargo.Freight forwarders managing selective consignments.

Why get

Single Transit Policy?

A single transit policy becomes invaluable if your enterprise engages in infrequent international trading but occasionally dispatches or receives merchandise across national boundaries. It facilitates the insurance of distinct consignments without binding you to an extended, comprehensive marine insurance scheme. Moreover, for exporters or importers navigating sporadic shipments, especially those dependent on seasonal demands, this policy is an apt choice, eliminating the obligations associated with ongoing marine insurance.In scenarios where shipments are rare or irregular, investing in continuous marine insurance might not yield cost efficiency. The single transit policy grants you the liberty to insure only those consignments that mandate coverage, mitigating extraneous expenses. This selective approach to insurance acquisition can optimize cost management and resource allocation. Furthermore, different consignments might exhibit varying degrees of associated risks.Customization is a hallmark of the single transit policy, enabling it to adapt its coverage scope to address the unique challenges faced by your cargo during transit. For instance, when you're involved in a trade fair or an exhibition, this policy can encapsulate the transit risks germane to that particular event, bypassing the necessity for an extended insurance engagement.Singular projects, especially those necessitating the transport of specialized or oversized cargo, can also benefit from the tailored protection offered by the single transit policy.

Coverages

A single transit policy encompasses a diverse range of coverages, such as:

This coverage provides protection from reasonable costs and expenses incurred by the insured due to required attendance at court proceedings, hearings, trials, and depositions related to the defense of a claim.

Exclusions

The following are common exclusions found in a single transit policy in India