Home > Finvest India Resource > Services > Best Financial Assessments Services in Bangalore

Financial Assessment Services In Bangalore By Finvest India

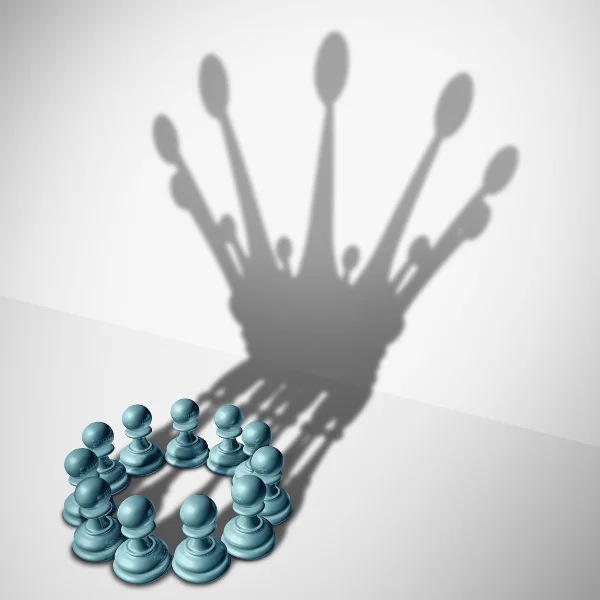

Tailored Financial Strategies Goal-Oriented Investment & Savings Support Across Life Stages

We specialize in delivering personalized, goal-oriented financial assessments tailored to your life stage, income level, and risk tolerance.

Build a Wealthy Future with Our Financial Assessments Services in Bangalore

As Bangalore grows into India’s leading IT and startup hub, financial planning has become essential for professionals, entrepreneurs, and investors. The city’s dynamic economy offers endless investment opportunities but also increasing complexity. That’s where our financial support comes in.

At Finvest India, we assist investors in navigating every stage of their financial journey. Whether you’re managing income, planning retirement, investing in real estate, or optimising taxes. Our team provide personalised guidance to help you achieve lasting wealth.

Our Process Of Performing Financial Assessment In Bangalore

We follow below process to ensure efficient financial assessment

Assess Current Financial Situation

Analyse the financial situation of an individual, as it helps our financial advisor get a clear understanding of your current financial standing.

Establish Financial Goal

We set the long-term and short-term financial goals and make sure that your goals are clear, realistic, and easily achievable.

Develop Personalized Plan

We create a personalized financial plan according to the needs.

Recommend Suitable Financial Products

We recommend the financial product according to the financial plan.

Execute & Track Financial Performance

We put the financial plan into action. After the financial plan is put into action, we monitor it and adjust it according to requirements.

Why Structured Financial Assessments Matters For People in Bangalore?

Protection of the Family

As a primary task, financial planning starts with life insurance. There is a heap of different life insurance products available on the market. Some of the investments are excellent and are ideal for financial protection vehicles. The situation of every individual in life is unique; an adviser can tell you which insurance policies fit you.

It helps in Saving and Spending

Long-term security meant building some assets. It is all about paying for emergencies and then for luxuries and holidays. The plans saving patterns can help build wealth quickly and efficiently.

Plans for Aging

After you plan for your short-term savings, you must consider the long-term procedures. Planning for retirement means sifting through tax rules, product options, and intricate asset combinations.

Security of House

Mortgages are complicated, especially after the crunch of credit. Lender requirements are more stringent. In addition to this, buying a home is often the most expensive decision you make in your life. Financial advisors often help save thousands of dollars. They seek for the best interest rates for their clients and help you assess levels for borrowing. They help in paying the down payment funds and could find mortgage lenders.

For Investments

As you get older, your income and assets increase, it is time to consider the step to how to enhance your financial position.

To Balance Assets

Investment helps in protecting assets against potential downturns and targets maximum growth. Higher returns often result in higher risk.

Why Choose Finvest India for Financial Assessment Services in Bangalore?

The journey of Finvest India was initiated in the year 1999. At the current time, the company Finvest India offers its services to 800+ satisfied Indian investors in India and across the Globe.

The beginning was with our senior solution provider embarking on the journey of facilitating Insurance services. Over the years, we have helped investors achieve their financial goals with effective and competent investment plans.

How Our Financial Assessment Service in Bangalore Help You?

Reduces the Tax Burden

Tax laws change often. Our team will guide you through tax-saving investments, capital gains management, and salary structuring to legally minimise liabilities.

Be Consistent in Your Investment

Avoid the trap of impulsive investing. We design disciplined investment strategies that build wealth steadily over time.

Adapt to Changing Priorities

As your life evolves, so should your financial goals. We help you adjust investments and asset allocations to align with your changing priorities.

Invest Smartly

Don’t fall for flashy schemes, trust expert insight. We help you identify genuine opportunities that suit your understanding, budget, and financial capacity.

Explore Our Financial Assessment Services in Bangalore

Retirement/Pension Schemes

Retirement plans are specially designed investment plans to cater to your post-retirement financial requirements. These plans help safeguard the monetary future and maintain financial independence without compromising your lifestyle. With the help of these plans, one can systematically save money to generate wealth to meet daily living expenses and take care of any unexpected medical emergencies post-retirement.

Child Future Care

As parents, kids are an essential part of our lives. To maintain a balance between the emotional life & practical life, managing spending and savings is one of the most crucial tasks to consider. Finvest India Plans have been specially customised to address your child’s future needs, even in your absence.

Goal-Based Investment

Goal-based investment is quite a new approach to wealth management that emphasises investing with a specific objective. Goal-based investing (GBI) involves a wealth manager or investment firm’s clients that measure their progress toward pertinent life goals. They might help save children’s education or build good wealth for retirement rather than focusing on beating the market.

Insurance Services

Finvest India offers comprehensive health coverage to meet the requirements of an individual or a group of individuals and your family through various health insurance plans. The plans are focused on helping the clients stay healthy through preventive care benefits. They are also more helpful in facilitating access to healthcare services at the time of necessity. Each option covers most of the same health services but also reduces those services and shares costs with you differently.

Type of Insurance Services Offered –

- Life Insurance

- Health Insurance

- Term Insurance

Save Tax with Us!

Calculation of Capital gains on the sale of Property. Finvest India’s in-house TAX Support Services will guide our clients on general and specific queries related to Taxation. The question can relate to Tax Saving Instruments, TDS, Income Tax, GST, and many more.

Our tax services will be helping with:

- Reducing your Tax Burden through Planning.

- Calculation of Capital Gains on the Sale of Property.

- Calculation of Capital Gains on SIPs or Mutual Funds.

Salary Restructuring Services

Salary restructuring plans can help employees to reduce their tax liability. This, as a result, can help in increasing their take-home salary. Restructuring the compensation for tax savings meant including more tax-free components without modifying your total wage. Salary is divided into various parts, including basic pay, HRA, LTA, special allowance, etc. The taxability of every component varies. Finvest India has a wide range of services to restructure the salaries in an organisation to avail maximum benefits of tax deductions.

Loan Plan

Financial limitations shouldn’t restrict the needs and wants of the client. Finvest India’s plans help accomplish financial responsibilities efficiently with our loan plan services.

Real Estate Reviews

The correct Tax plan is one of the most important factors to take into consideration; that’s why Finvest India guides & helps you ensure that you can save & invest in tax.

Other Services

- Cashflow & Expense Management

- NRI Investments

- Portfolio Management Services (PMS)

- HUF Investments

- Estate Equalization

Benefits of Working With Finvest India's Financial Assessment Services

- Take the Burden Off Your Shoulders: Managing personal finances can be stressful. Our advisors handle investment planning and financial management so you can focus on your life and career.

- Plan for Income Distribution: We help retirees and professionals design effective income distribution strategies that ensure long-term financial security.

- Customise Your Financial Strategy: Our Financial planning services near you offer tailored solutions that align with your life goals, risk tolerance, and aspirations.

Take the Next Step Toward Smarter Finances

FAQ On Financial Assessment Services In Bangalore

How much financial services can cost me?

It depends upon the total assets and the level of service provided, as the fees include continuous portfolio management.

What is the best age to start financial Assessment??

Financial Assessments can start as early as one starts earning. Early investing allows more time for compounding.

Can we use digital platform for investment?

Yes, we can use digital platforms that manage investment if people have a small portfolio or want a low cost.

Is my personal financial data secure?

Yes, personal financial data will be secure as we maintain confidentiality and data protection standard.

Is financial assessment only for high-income individuals?

No, financial assessment can be done by anyone who earns ,wanted to save and invest regardless of income level.

Who Should Opt for Financial Analysis Services?

Salaried professionals , Startup founders & entrepreneurs , Young couples,High-net-worth individuals, NRIs, Retirees