Table of Contents

Introduction: 4 Leading Areas Of Financial Assessment In Bangalore

In this blog, we will explore 4 leading areas of financial assessment in Bangalore. From the booming economy to real estate investments, retirement planning, tax planning, and wealth management, there’s something here for everyone.

Bangalore’s Booming Economy

Bangalore has become a haven for financial planners and investors alike. From helping individuals plan for their retirement to guiding them through tax-saving investments, structured financial assessments have their hands full.

Structured Financial assessment is not just about counting every penny; it’s about making smart decisions to secure your future. So, whether you’re a tech pro or a newbie investor, Bangalore offers many financial assessment options that fit your needs.

Areas Of Financial Assessment With Real Estate Investments

Important Things Before Investment

- Area connectivity

- Closeness to schools, hospitals and facilities

- Potential for future growth

Emphasis On Legal & Financial Aspects

- Verify property validity

- Hire a trusted attorney

- Be sure there are no hidden surprises

Golden Rule of Real Estate Investment

- Full financial analysis

- Make investments fit into the overall financial plan

- Reminder: Real estate investing requires strategy, intelligence, and a little luck.

- Success in Bangalore’s evolving real estate market with meticulous planning and a unique approach.

Areas Of Financial Assessment For Retirement

- Retirement planning is often viewed as a burdensome task that people want to avoid.

- However, it is a reality that everyone must face sooner or later.

- A major challenge is to save enough money to support your lifestyle after retirement.

It can feel like a constant struggle, as inflation eats away at savings over time. - There are various investment options available, like mutual funds and fixed deposits, which can help secure one’s financial future.

- It is important to strike the right balance between risk and reward in investment.

Starting retirement planning early gives investments more time to grow and grow. - The sooner you start, the better chance you’ll have of building a strong retirement fund.

- A humorous analogy is used to highlight the advantages of early planning.

- It emphasizes that retirement planning, although difficult, can be completed with the right mindset and a touch of humour.

- Encourages viewing challenges as opportunities and urges readers to unleash their financial skills.

- Advice is being prepared for the late-night budget session, possibly with the help of coffee.

Tax Planning

Introduction To Taxes

- Taxes can be burdensome and frustrating.

- They can make one question mean everything.

Objectives of tax planning

- Tax planning is a solution to deal with the complexities of taxes.

Understanding The Indian Tax System

- The Indian tax system is complex and understanding it can feel like a mystery.

- It includes many taxes including Income Tax and GST.

- Tax slabs and discounts are subject to change.

Tax-Saving Investment Option

- The government provides instruments like PPF and NSC to reduce tax liability.

- They are like a group of tax-avoiding superheroes.

Optimize Tax Liabilities

- Taxes owed can be reduced by keeping track of expenses and using deductions and exemptions.

- It’s like finding a missing puzzle piece to complete the picture.

Tax Planning Incentives

- Encourages the reader to wear their thinking cap or superhero hat.

- Assured that with knowledge and other areas of financial planning, anyone can overcome taxes.

Final note

- It is emphasized that tax planning, although tough, can defeat the tax monster.

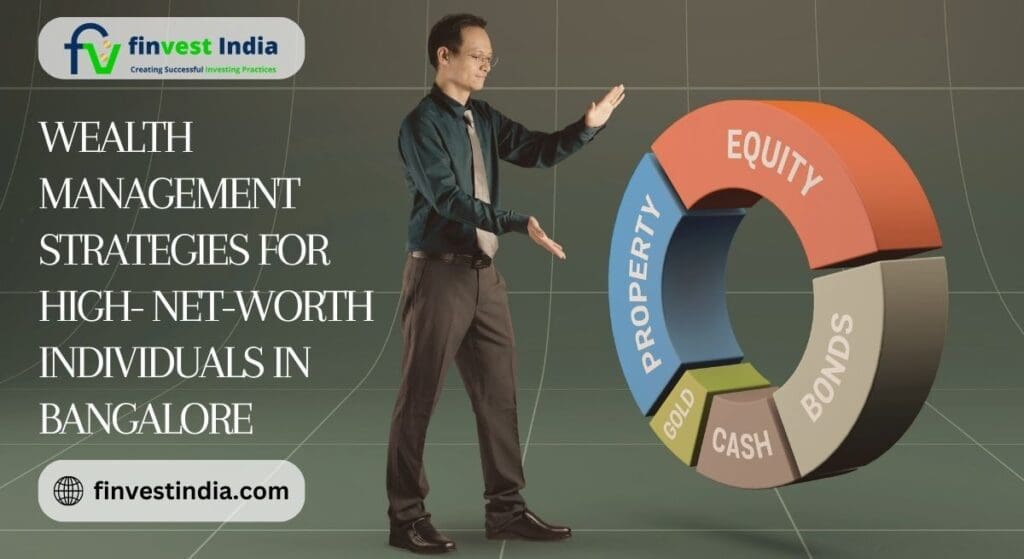

Wealth Management

Wealth Management Is Challenging

- Managing and growing money is a complicated task.

- It’s like juggling flaming swords while riding a unicycle – it requires skill, accuracy and a little bit of luck.

- The speaker offers to guide us in dealing with the areas of financial planning.

Diversification Is Important

- Diversification is a major strategy in money management.

- It’s like that saying “Don’t put all your eggs in one basket.”

- Spread investments across different sectors, regions and asset classes for protection.

Consider The Need For A Financial Service Provider

- Whether you need a financial service provider or not depends on your knowledge, skills and confidence in money management.

- If you are efficient and have time, you can manage your own. Otherwise, a financial advisor might be helpful.

- They provide guidance, keep you on track, and prevent expensive mistakes.

Wealth Management Is Long-Term

- Wealth management is a long-term endeavour.

- This involves making informed decisions and adapting to changes in the market.

Qualities Required For Money Management

- Patience, discipline and a good sense of humour are required.

- Laughter can be a part of the trip.

Conclusion

- The section on money management concludes by pointing to more adventures in financial assessment ahead.

Conclusion

Key Takeaways:

- Whether you’re a property investor, a retiree, or someone looking to optimize their tax liabilities, there’s something here for everyone.

- Real estate investments are the other areas of financial assessment in Bangalore. If you’re thinking of taking the plunge, consider the rapid growth of the sector, key neighbourhoods, and the factors that can make or break your investment.

- Retirement planning shouldn’t be an afterthought. Start early, explore investment options, and secure your future. It’s never too early to plan for those golden years.

- Understanding the Indian tax system can feel like navigating a maze. But fear not, there are tax-saving investment options and some handy tips to help you optimize your tax liabilities.

- Wealth management is a delicate dance between managing and growing your wealth. Explore diversification strategies, consider the pros and cons of a financial service provider vs self-management, and watch your fortune grow.